sacramento property tax rate 2021

Start filing your tax return now. Sacramento Property Tax Rate 2021.

Business Property Tax In California What You Need To Know

3636 American River Drive Suite 200 M ap.

. The property tax rate in the county is 078. Transfer tax can be assessed as a percentage of the propertys final sale price or simply a flat fee. For more information view the Parcel Viewer page.

TAX DAY NOW MAY 17th - There are -346 days left until taxes are due. Its also home to the state capital of California. This is the total of state county and city sales tax rates.

To calculate the amount of transfer tax you owe simply use the following formula. This tax has existed since 1978. Identify the total amount of your state county city transfer tax.

Median Property Tax Rates By State Ranked highest to lowest by median property tax as percentage of home value 1 1 New Jersey 189 2 New Hampshire 186 3 Texas 181 4. Did South Dakota v. Ad Uncover Available Property Tax Data By Searching Any Address.

Whether you are already a resident or just considering moving to Sacramento to live or invest in real estate estimate local property tax rates and learn how real estate tax works. 2020-2021 compilation of tax rates by code area code area 03-014 code area 03-015 code area 03-016 county wide 1 10000 county wide 1 10000 county wide 1 10000 los rios coll gob 00223 los rios coll gob 00223 los rios coll gob 00223 sacto unified gob 01171 sacto unified gob 01171 sacto unified gob 01171. The California sales tax rate is currently.

The commission also held first readings for real and personal property tax rates. Sacramento County is located in northern California and has a population of just over 15 million people. This does not include personal unsecured property tax bills issued for boats business equipment aircraft etc.

Los Rios Coll Gob. This tax is charged on all NON-Exempt real property transfers that take place in the City limits. What is the sales tax rate in Sacramento California.

Learn more About Us. They can be reached Monday 100 pm - 400 pm and Tuesday - Friday. July 2 2021 - Sacramento County Assessor Christina Wynn announced today that the annual assessment roll topped 199 billion a 519 increase over last year.

2021-22 1036 104 101036 1 Increase to base year value is limited to 2 percent pursuant to California Constitution article XIII A section 2b. 10000 485208. The assessment roll reflects the total gross assessed value of locally assessed real business and personal property in Sacramento County as of January 1 2021.

City level tax rates in this county apply to assessed value which is equal to the sales price of recently purchased homes. The minimum combined 2022 sales tax rate for Sacramento California is. Sacramento County has one of the highest median property taxes in the United States and is ranked 359th of the 3143 counties in order of.

Our Mission - We provide equitable timely and accurate property tax assessments and information. 110 for each 1000. Sacramento County collects on average 068 of a propertys assessed fair market value as property tax.

Our Responsibility - The Assessor is elected by the people of Sacramento County and is responsible for locating taxable property in the County assessing the value identifying the owner and publishing annual and supplemental assessment rolls. The County sales tax rate is. Learn all about Sacramento real estate tax.

The undersigned certify that as of June 18 2021 the internet website of the California Department of Tax and Fee. 2021-2022 compilation of tax rates by code area code area 03-014 code area 03-015 code area 03-016 county wide 1 10000 county wide 1 10000 county wide 1 10000 los rios coll gob 00249 los rios coll gob 00249 los rios coll gob 00249 sacto unified gob 00918 sacto unified gob 00918 sacto unified gob 00918. Permits and Taxes facilitates the collection of this fee.

Real Estate Tax Rate. Tax Collection and Licensing. The median property tax also known as real estate tax in Sacramento County is 220400 per year based on a median home value of 32420000 and a median effective property tax rate of 068 of property value.

00249 12082. The Sacramento sales tax rate is. View the E-Prop-Tax page for more information.

Property information and maps are available for review using the Parcel Viewer Application. We Provide Homeowner Data Including Property Tax Liens Deeds More. California City County Sales Use Tax Rates effective April 1 2022 These rates may be outdated.

Calculating The Sacramento County Transfer Tax. The median property tax in Sacramento County California is 2204 per year for a home worth the median value of 324200. Tax rate Tax amount.

Finance 700 H Street Room 1710 First Floor Sacramento CA 95814 916-874-6622 or e-mail Additional Information. Enter an Address to Receive a Complete Property Report with Tax Assessments More. Ad Search County Records in Your State to Find the Property Tax on Any Address.

00918 44542. Here is a list of states in order of lowest ranking property tax to highest. The property crime rate in sacramento is 31821 per 100000 people.

Sacramento County collects relatively high property taxes and is ranked in the top half of all counties in the. For purchase information please see our Fee Schedule web page or contact the Assessors Office public counter at 916 875-0700.

How To Calculate Property Tax Everything You Need To Know New Venture Escrow

Why Now Is The Best Time To Refinance Your Home Real Estate Tips Real Estate Advice Mortgage Tips

Davlyn Investments Acquires Terraces At Highland Reserve Apartment Complex Near Sacramento For 95m Rebusi Sacramento Apartments Terrace Roseville California

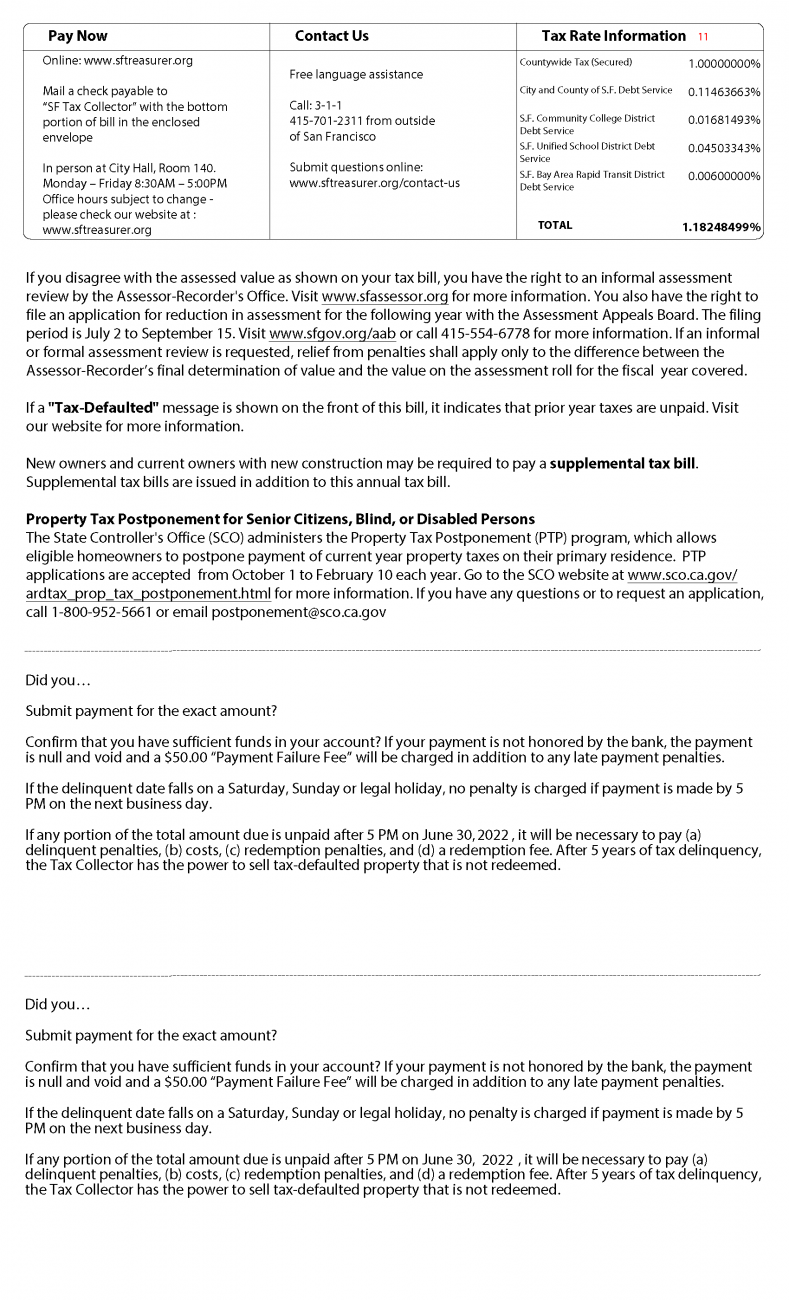

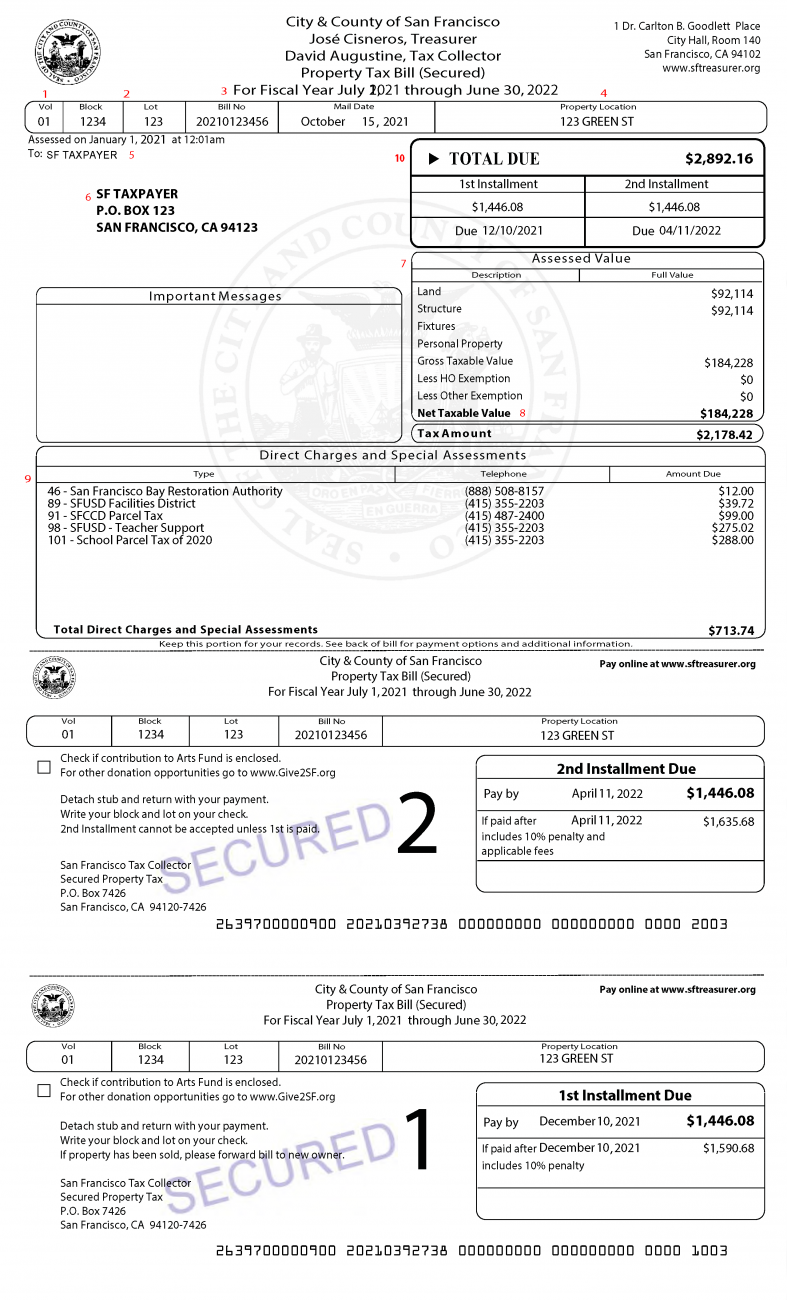

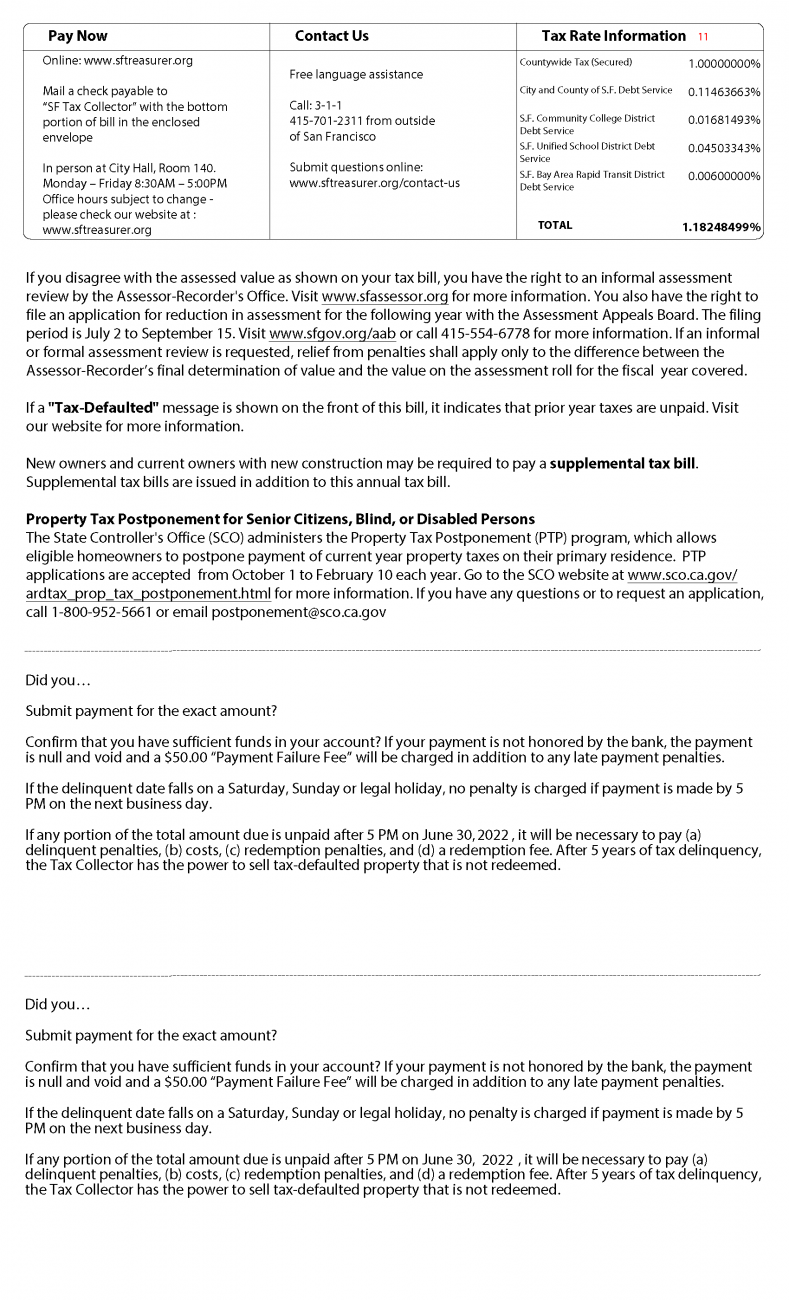

Secured Property Taxes Treasurer Tax Collector

Secured Property Taxes Treasurer Tax Collector

Property Taxes Department Of Tax And Collections County Of Santa Clara

Sacramento County Ca Property Tax Search And Records Propertyshark

Secured Property Taxes Treasurer Tax Collector

How To Calculate Property Tax Everything You Need To Know New Venture Escrow

3745 Las Pasas Way Sacramento Ca 95864 Mls 19036325 Zillow Home Loans Home Inspector Zillow

2022 California Property Tax Rules To Know

Property Tax California H R Block

Untitled Design Presentation 16 9 Mortgage Payment Calculator Adjustable Rate Mortgage Mortgage Payment

Housing In Infrastructure Bill Real Estate Agent And Sales In Pa Anthony Didonato Broomall Media Delaware Coun Infrastructure Sale House Real Estate News

Sacramento County Ca Property Tax Search And Records Propertyshark

American Express Blue Business Cash Card Review 2022 2 Back To Your Bottom Line Cash Card Small Business Credit Cards Compare Cards

Income Tax Deadline Extended But Property Tax Deadline Stays The Same April 12 County Of San Bernardino Countywire

Cash For Keys Agreement Form Aaoa Being A Landlord Real Estate Forms Agreement

How To Calculate Property Tax Everything You Need To Know New Venture Escrow